FDNY Tier 3 Escalation: Understanding the Real Ceiling

A capital-markets framework for understanding how escalation works under Tier 3

In the first piece, we quantified the Tier 3 pension change across three dimensions: time, cash flow, and asset value. That analysis focused on the floor of the pension — what a Tier 3 member is guaranteed at 20 years.

This piece addresses the ceiling of the Tier 3 pension.

Specifically, how escalation works, what is required to earn it, and how to think about its economic value using the same capital-markets lens.

To keep the analysis consistent, we continue to examine outcomes through the lens of a 52-year-old Tier 3 retiree, recognizing that individual results will vary.

How Escalation Is Earned

Full escalation under Tier 3 is achieved at 25 years of service, but not all at once. It is earned incrementally, beginning after 22 years of service.

Each month worked beyond 22 years accrues 1/36th of full escalation, meaning:

At 22 years: no escalation

At 23 years: one-third escalation

At 24 years: two-thirds escalation

At 25 years: full escalation

Escalation is not a bonus. It is earned service credit, just like the base pension.

The 20–22 Decision Window

Restoring the ability to retire at 20 years changed how the path to escalation is experienced.

Escalation still does not begin until after 22 years, which means there is now a two-year period — from years 20 to 22 — where a member can retire, but staying longer does not yet improve the pension.

Importantly, this period is not a dead zone. Members who stay continue to earn salary that is typically higher than their potential pension, along with benefits, overtime opportunities, and promotional opportunities.

The real tradeoff is time.

In simple terms, the choice looks like this:

Retire at 20: begin collecting pension immediately and gain time and flexibility.

Stay from 20 to 22: continue earning salary, delay pension collection, and preserve the ability to begin earning escalation later.

The mechanics of escalation are unchanged; the path to escalation can now feel longer psychologically.

Why Escalation Matters Economically

A non-escalating pension is a nominal income stream. Its purchasing power erodes over time.

A fully escalating pension is a real income stream. Its purchasing power is preserved.

From a capital-markets perspective, this distinction is critical. Markets consistently place a premium on inflation-protected cash flows, particularly over long durations.

Escalation does not increase the pension percentage. It changes the risk profile of the income stream.

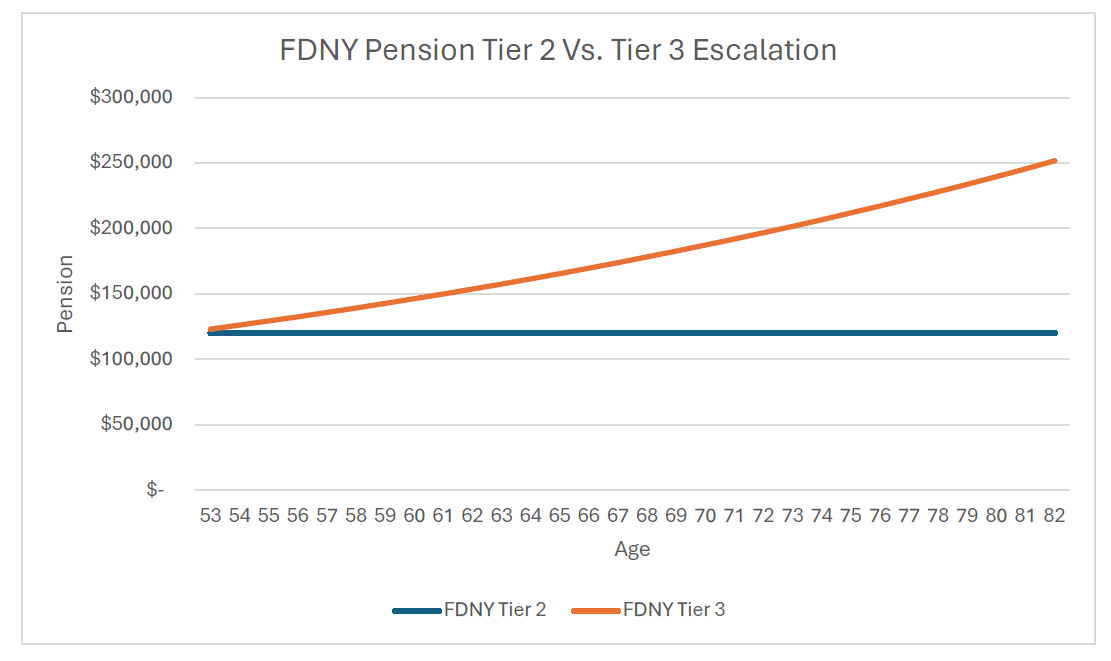

A Valuation Comparison: Tier 2 vs. Tier 3

To isolate the economic value of escalation, assume two pensions that are identical in every respect except inflation protection.

Assumptions:

After-tax pension at retirement: $120,000

Expected collection period: 30 years

Discount rate: 4.9%

Tier 2 pension: flat (no escalation)

Tier 3 pension: full escalation, assumed to track 2.5% inflation

Valuation Estimates:

A flat $120,000 pension has a present value of approximately $1.87 million

An escalating $120,000 pension has a present value of approximately $2.52 million

The difference — roughly $650,000 of present value — is attributable solely to inflation protection.

The valuation math is important, but it also helps to see how this plays out over time. After 30 years, a Tier 2 pension that starts at $120,000 with no escalation remains $120,000 (ignoring immaterial COLA), while a Tier 3 pension with full escalation grows to approximately $252,000.

All else equal, and before accounting for the Social Security offset, a fully escalating Tier 3 pension is more valuable than a non-escalating Tier 2 pension.

Does It Make Sense to Stay Beyond 25 Years?

After 25 years of service:

No additional pension percentage accrues

Escalation is fully earned

The pension formula is complete

The only financial benefit of staying longer is a higher salary, which must be weighed against the opportunity cost of delaying retirement.

There is no universal answer. What matters is that the decision is made with a clear understanding of the tradeoffs.

Bottom Line

Escalation is the most powerful and least understood component of the Tier 3 pension.

Escalation:

Converts a nominal pension into a real one

Preserves purchasing power over decades

Adds substantial economic value

Requires a deliberate tradeoff between time and long-term income protection

In the next piece, we incorporate the Social Security offset to assess how much of this value ultimately survives.

That is where the full picture comes into focus.